Journal Entry For Underapplied Overhead

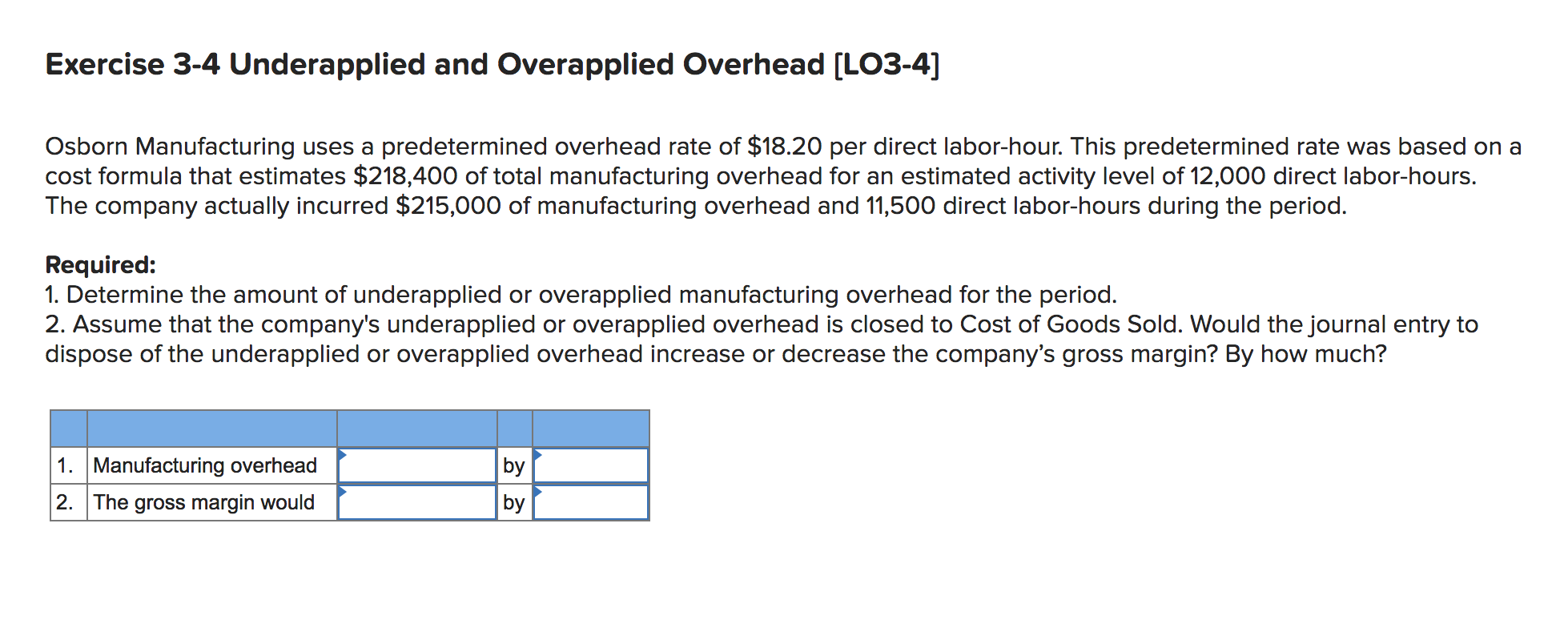

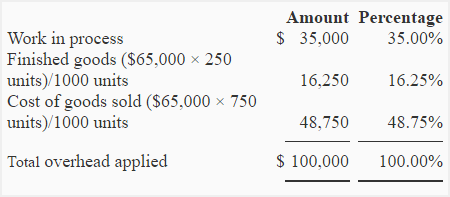

If the overhead was overapplied and the actual overhead was 248000 and the applied overhead was 250000 the entry would be. To adjust for overapplied or underapplied manufacturing overhead some companies have a more complicated three-part allocation to work in process finished goods and cost of goods sold.

Answered Exercise 3 4 Underapplied And Bartleby

Answered Exercise 3 4 Underapplied And Bartleby

November after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to.

Journal entry for underapplied overhead. Ad Free Delivery Worldwide On All Orders - Great Prices On Over 20 Million Books. 2If a company has overapplied overhead then the journal entry to dispose of it could possibly include. Solutions to Review Problem 23.

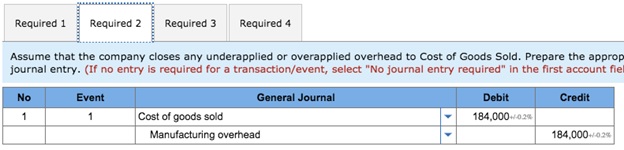

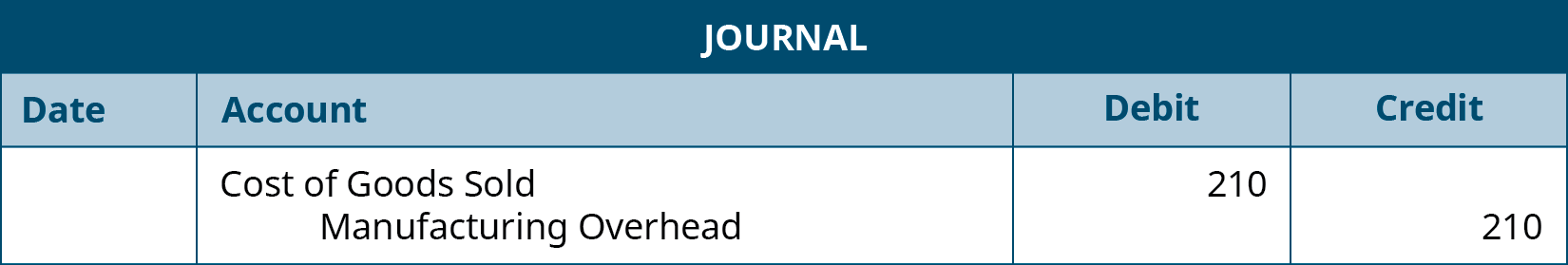

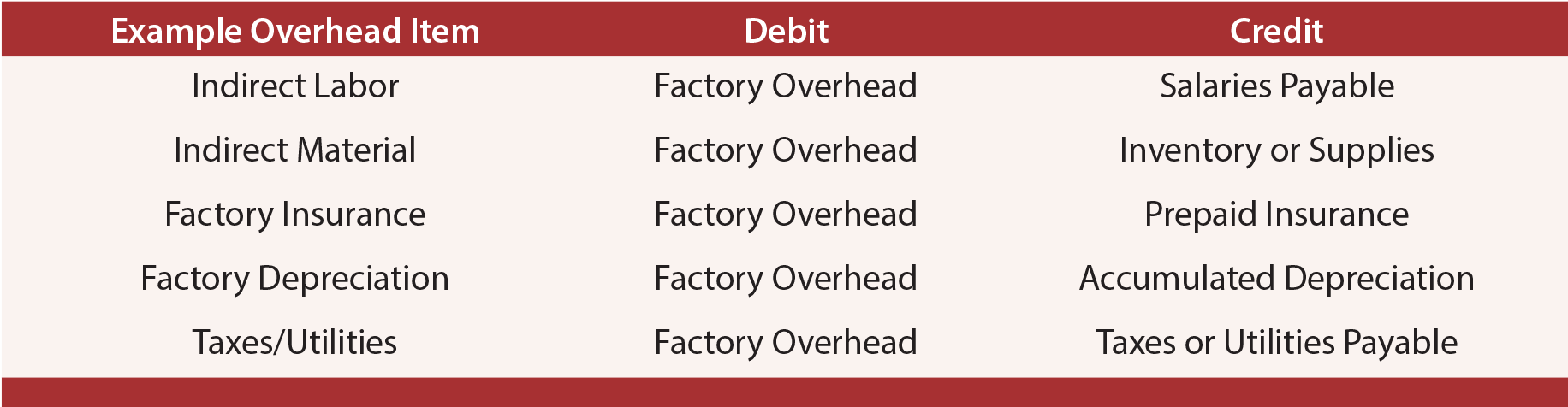

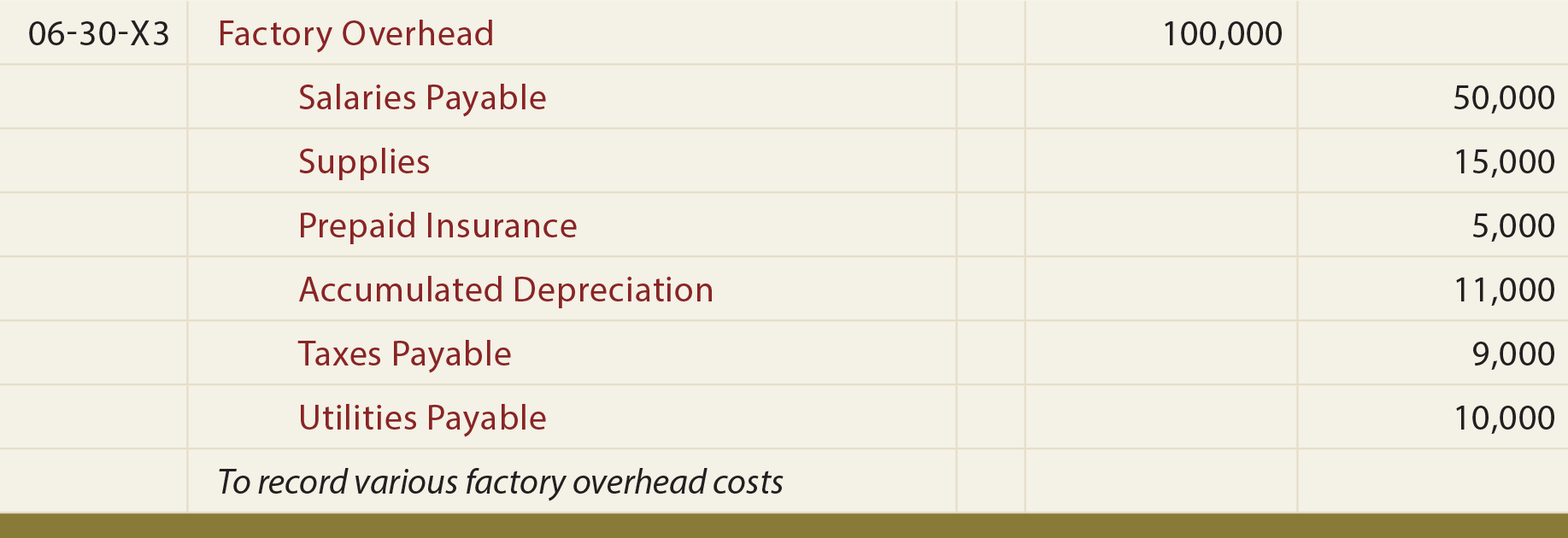

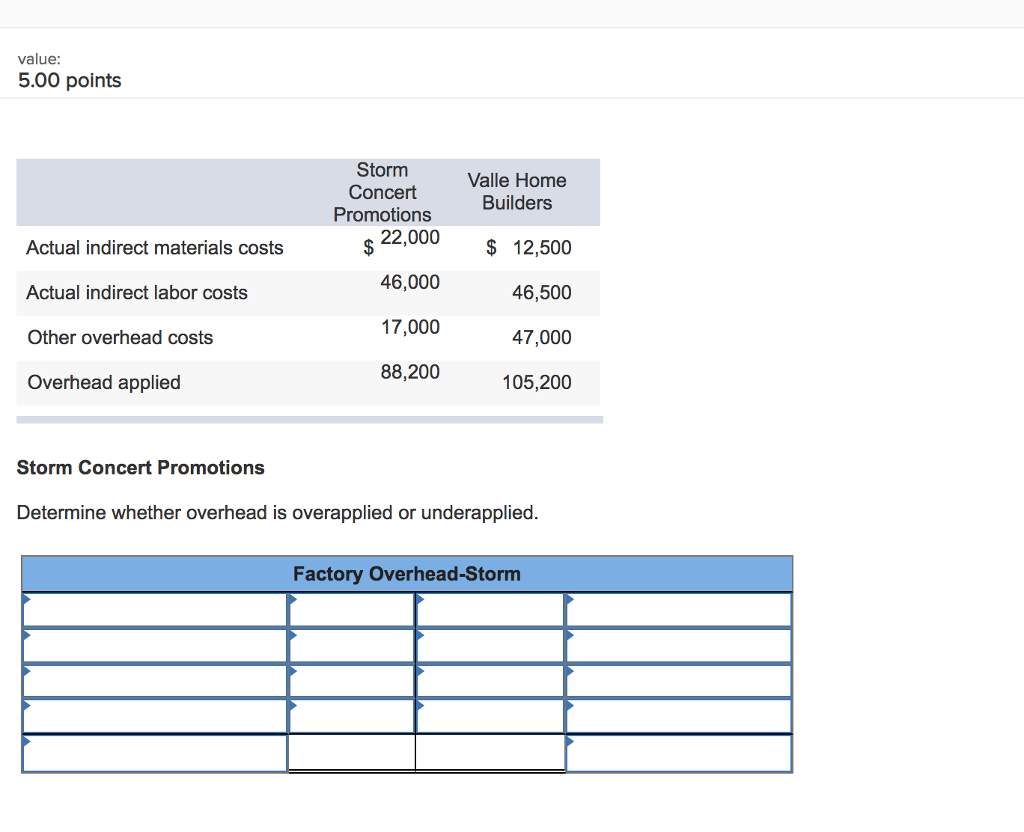

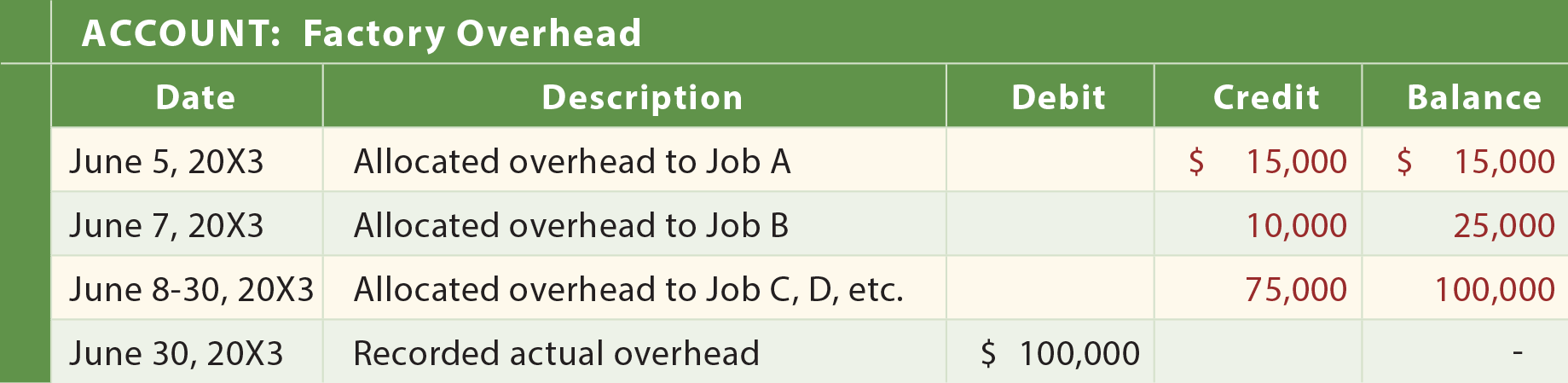

The following journal entry is made to dispose off an over or under-applied overhead. The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for November would include the following. Make the journal entry to close the manufacturing overhead account assuming the balance is material.

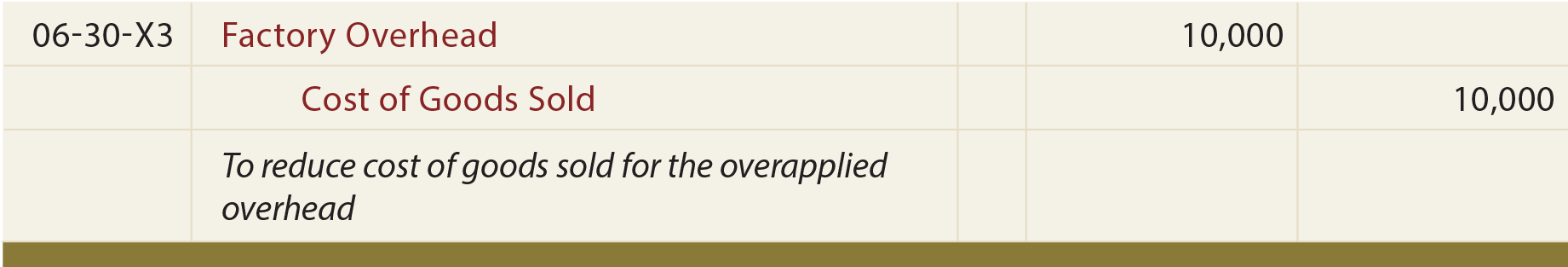

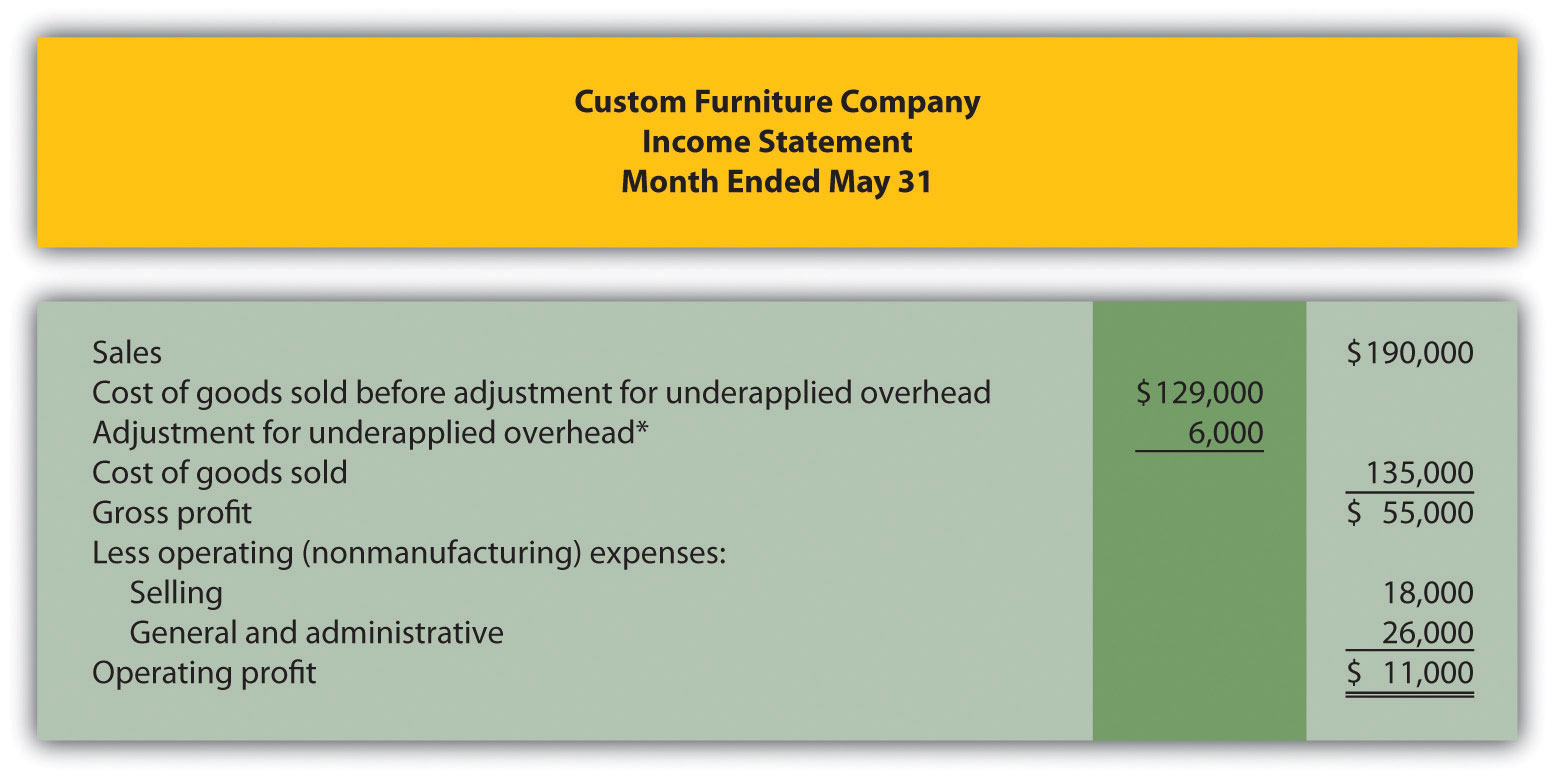

The next journal entry shows the reduction of cost of goods sold to offset the amount of overapplied overhead. Rice University Openstax CC BY SA 40. The adjusting journal entry is.

This is usually viewed as a favorable outcome because less has been spent than anticipated for the level of achieved production. Overhead rate Manufacturing overhead Labor hours Overhead rate 324000 36000 900 per labor hour So on a particular job which involved say 100 hours of labor the applied over-head would be 100 x 900 900. Make the journal entry to close the manufacturing overhead account assuming the balance is immaterial.

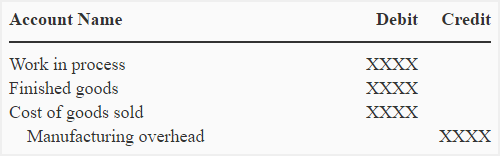

Transferring the entire amount of over or under-applied to cost of goods sold. For example the standard allocation rate might be designed to allocate 200000 of factory overhead to units of production and there is an under-application of 25000. Manufacturing overhead Cost of goods sold Dr Cr After passing one of these journal entries cost of goods sold is adjusted.

Ad Free Delivery Worldwide On All Orders - Great Prices On Over 20 Million Books. If applied overhead was less than actual overhead we have under-applied overhead or not charged enough cost. Include which of the following accounts.

When overhead is under-applied. The adjusting journal entry is. Therefore the overhead is under-applied.

The journal to post the applied overhead is as follows. The only disadvantage of this method is that it is more time consuming. 135000 --Under-applied over-applied overhead.

Manufacturing overhead cost applied to work in process during the year. This method is more accurate than second method. In this case Mind the Cap has underapplied its manufacturing overhead by 25000 250000 - 225000 and an adjustment is required to dispose of the difference.

Where the overhead is overapplied the following journal entry is made. When overhead is over-applied. The entry to correct under-applied overhead using cost of goods sold would be XX represents the amount of under-applied overheard or the.

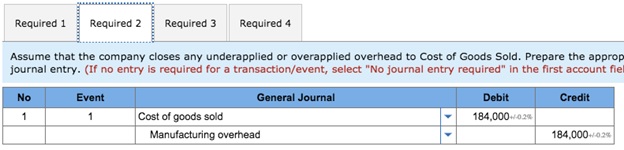

Closing out the balance in manufacturing overhead account to cost of goods sold is simpler than the allocation method. Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead. The journal entry to dispose of underapplied or overapplied overhead will never Manufacturing Overhead Raw Materials.

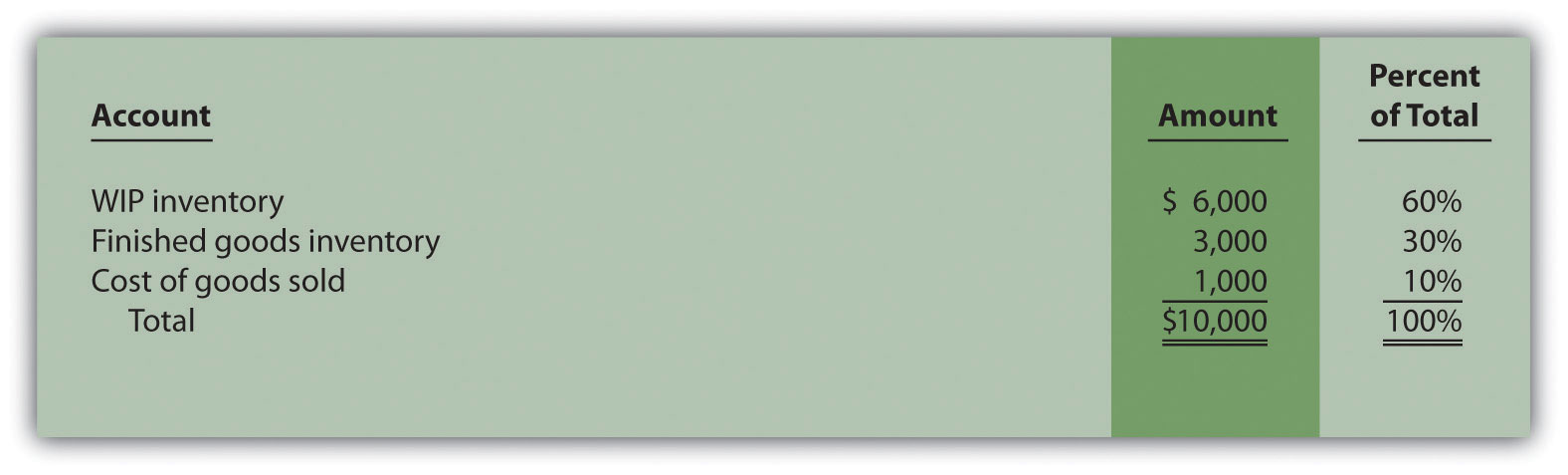

To adjust for overapplied or underapplied manufacturing overhead some companies have a more complicated three-part allocation to work in process finished goods and cost of goods sold. Record the journal entry to close over-or underapplied factory overhead to cost of goods sold for each of the independent cases below. After passing one of these journal entries cost of goods sold is adjusted.

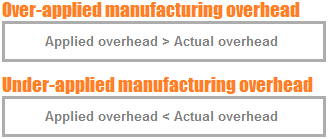

Consequently cost of goods sold is increased by the amount of underapplied and decreased by the amount of overapplied overhead. If the overhead was overapplied and the actual overhead was 248000 and the applied overhead was 250000 the entry would be. Is overhead overapplied or underapplied.

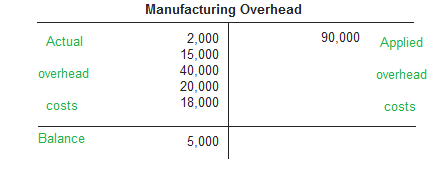

If the overhead was overapplied and the actual overhead was 248000 and the applied overhead was 250000 the entry would be. The adjusting journal entry is. 18000 5000 For company A notice that the amount of overhead cost that has been applied to work in process 272000 is less than the actual overhead cost for the year 290000.

Credit to Work in Process of 250. If the applied overhead exceeds the actual amount incurred overhead is said to be overapplied. The predetermined overhead rate is calculated as follows.

Cost of Goods Sold. Since manufacturing overhead has a debit balance it is underapplied as it has not been completely allocated. Underapplied overhead indicates that the actual amount of factory overhead incurred was greater than expected.

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Solved Prepare The Adjusting Entry To Allocate Any Over Chegg Com

Solved Prepare The Adjusting Entry To Allocate Any Over Chegg Com

Determine And Dispose Of Underapplied Or Overapplied Overhead

Determine And Dispose Of Underapplied Or Overapplied Overhead

Overapplied Overhead Journal Entry Page 1 Line 17qq Com

Overapplied Overhead Journal Entry Page 1 Line 17qq Com

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Determine And Dispose Of Underapplied Or Overapplied Overhead

Determine And Dispose Of Underapplied Or Overapplied Overhead

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Sample Assignment On Accounting Question Assignment

Sample Assignment On Accounting Question Assignment

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Solved Prepare The Journal Entry To Allocate Close Over Chegg Com

Solved Prepare The Journal Entry To Allocate Close Over Chegg Com

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Over Or Under Applied Manufacturing Overhead Explanation Journal Entries And Example Accounting For Management

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

1 How Is Job Costing Used To Track Production Costs Business Libretexts

1 How Is Job Costing Used To Track Production Costs Business Libretexts

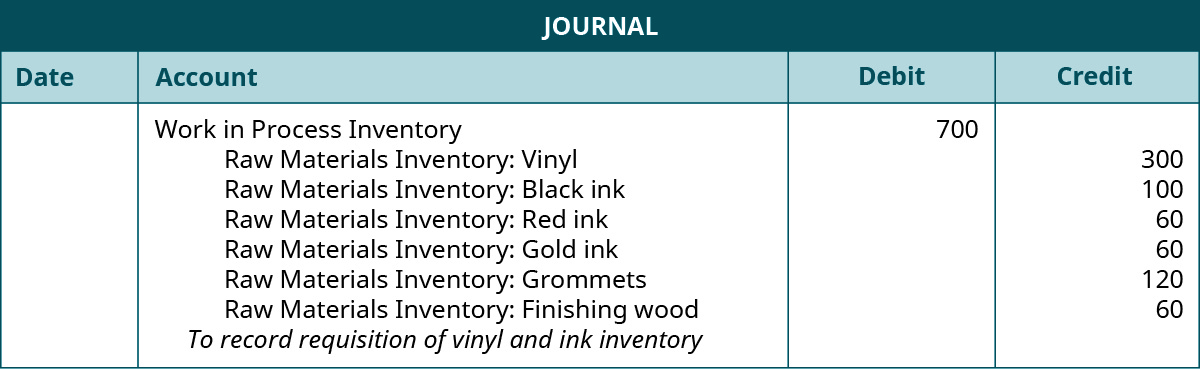

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

Assigning Manufacturing Overhead Costs To Jobs Accounting For Managers

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Accounting For Actual And Applied Overhead Principlesofaccounting Com

Comments

Post a Comment